Know Your Numbers. Make Confident Decisions.

Get proactive financial guidance without the complexity. Finoya watches your business continuously, forecasts what’s coming next. So you can make confident decisions without being a finance expert.

✓ 7 Day Free Trial. No Credit Card Needed.

Finoya connects with 20 plus accounting platforms and keeps your data automatically in sync. Set up in under 5 minutes.

🔒 Your client data is always private, encrypted, and secure.

Questions you can ask AI CFO every week

“Can we afford to hire someone?”

You want to grow, but you’re not sure if the cash is really there. What if sales slow down? What if expenses spike?

“Should we take this opportunity?”

A big project, new equipment, office expansion it sounds great, but will it drain your cash? How do you know if it’s the right time?

“When can I actually pay myself more?”

You’ve been reinvesting everything back into the business. But when is it safe to take a real salary without putting the business at risk?

“What happens if that big invoice pays late?”

Your largest customer usually pays on time, but what if they don’t? Can you still make payroll? Cover your bills?

“Are we actually profitable or just busy?”

Revenue is coming in, but somehow there’s never enough cash. Are you making money or just breaking even?

You Need Answers Between Accountant Meetings

Your accountant or bookkeeper does essential work keeping your books clean, filing taxes, ensuring compliance. But they’re not available 24/7 for every business decision you need to make.

That’s where your AI CFO comes in.

It works alongside your accounting team, giving you instant insights between meetings so you can make decisions when opportunities arise not weeks later. Your accountant stays focused on what they do best, while you get the daily financial guidance you need to run and grow your business.

Think of it as your financial co-pilot between accountant check-ins.

Why AI CFO does your business

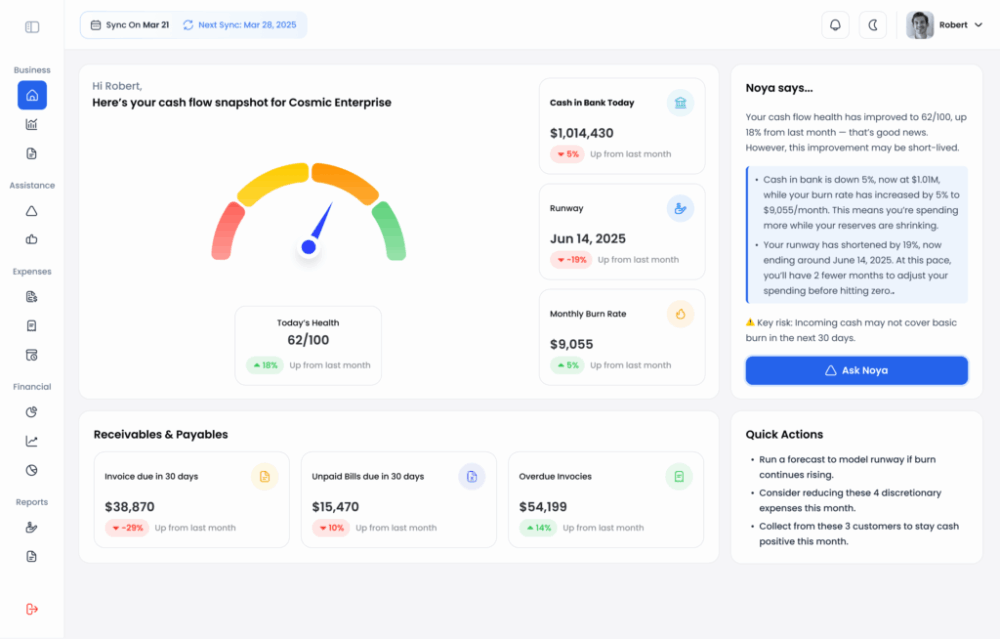

Your Proactive AI CFO That Never Sleeps

Finoya doesn’t wait for you to ask questions. It actively watches your business 24/7 and tells you what needs attention before problems develop.

Watches Your Cash Flow Continuously

While you’re running your business, Finoya monitors every transaction, invoice, and payment. It spots patterns, tracks trends, and alerts you when something needs your attention before it becomes urgent.

Warns You Early About Problems

Get proactive alerts when invoices are aging beyond normal, expenses are trending up, or cash is heading toward tight territory. Fix issues 2-4 weeks early instead of scrambling at the last minute.

Forecasts What’s Coming Next

Know your cash position Today, 30, 60, and 90 days out based on your actual business patterns. See upcoming bill spikes, seasonal dips, and when that big project payment really hits your account.

Finds Opportunities You’d Miss

Finoya spots when you have extra cash capacity for growth, when a customer’s payment pattern changes, or when your margins are improving. It actively looks for what’s working so you can do more of it.

Answers Your “What If” Questions Instantly

Use the Scenario Planning page and find out quick answers to queries like : “Can we afford two new hires?” or “What happens if revenue drops 20%?” Get specific answers in seconds based on your real numbers test every decision before you commit.

Makes Complex Analysis Simple

You don’t need to be a finance expert. Finoya does the heavy analysis in the background and explains everything in straightforward language. No jargon, no confusion just clear insights you can act on.

The key difference: Finoya is proactive, not reactive. It finds issues and opportunities before you even think to look.

How it works?

Connect Your Accounting Software (2 minutes)

Link QuickBooks, Xero, or your accounting platform via secure connection. No files to upload, no data to enter manually.

Finoya Syncs and Learns Your Business (Automatic)

Your AI CFO pulls in your financial data weekly and learns your business patterns: typical payment cycles, seasonal trends, expense patterns, revenue rhythms.

Get Proactive AI Insights Immediately

Within minutes, you’ll see your cash flow health and what’s coming next. Finoya starts monitoring continuously and alerts you when anything needs attention.

Ask Questions Anytime, Get Instant Answers

“Can we afford this?” “What if sales drop?” “Should we take this loan?” Your AI CFO answers based on your actual business data no waiting, no guessing.

Make Decisions With Confidence

No more uncertainty. You know what’s safe, what’s risky, and exactly how decisions will impact your cash position.

Important: Your Books Need to Be Current

Finoya is incredibly powerful, but it needs accurate data to give you accurate insights.

If your books aren’t reconciled or you’re months behind on bookkeeping, Finoya will analyze outdated information which means the guidance won’t be reliable.

The good news: Most business owners already have an accountant or bookkeeper keeping their books current. If you do, you’re ready to go. If your books need catching up, talk to your accountant first they’ll get you current quickly, and then Finoya can give you the proactive insights you need.

Think of it this way:

- Your accountant/bookkeeper = Keeps your financial records accurate and compliant

- Finoya = Turns those accurate records into daily business guidance

They work together to give you the complete financial picture.

Before Finoya:

- You check your bank balance and think it’s enough

- You find out about cash flow problems when they’re already urgent

- You wait days or weeks to get answers from your accountant

- You spend hours trying to build forecasts in spreadsheets or ask ChatGPT

- You lose sleep wondering if you can make payroll next month

- You feel stressed about every major business decision

After Finoya:

- You know your exact cash position and what’s coming for the next 90 days

- You make decisions confidently based on real data and scenarios

- Forecasts update automatically based on your actual business patterns

- You test opportunities in 30 seconds and know exactly what’s safe

- You sleep better knowing your AI CFO is watching continuously

- You feel confident and in control of your business finances

FAQ for Business Owners/Founders

Do I need to be good with numbers to use Finoya?

Not at all. Finoya is built for business owners and founders, not accountants. You ask questions in plain English (“Can we afford to hire?”) and get straightforward answers. No finance acumen required.

How is this different from ChatGPT or generic AI tools?

Generic AI does not know your business financial numbers. You need to upload all your business financial data each week. It answers based on assumptions and general patterns. Finoya connects directly to your accounting platform and generates insights from real transactions, invoices, receivables, payables, and cash position. The difference is simple. Finoya is grounded in actual financial data and controlled financial logic.

How is this different from just looking at my bank balance?

Your bank balance shows you today. Finoya shows you what’s coming money you’re owed, bills you need to pay, and how decisions impact your cash 30-90 days out. It’s the difference between driving by looking at your feet versus looking at the road ahead.

Will this replace my accountant or bookkeeper?

Absolutely not. Your accountant and bookkeeper are essential. They keep your books accurate, handle tax compliance, and ensure your financial records are correct. Finoya needs that accurate data to give you reliable insights.

Think of it this way: Your accountant/bookkeeper maintains your financial foundation. Finoya uses that foundation to give you proactive, daily business guidance. They’re complementary, not competing. Many accountants actually recommend Finoya to their clients because it helps business owners make better decisions between meetings and ask more informed questions.

What if my books aren't up to date?

Finoya needs current, accurate data to give you reliable insights. If your books are behind, talk to your accountant or bookkeeper about getting caught up first. Once your books are current, Finoya can immediately start providing proactive guidance. Most business owners who use accounting software are already keeping their books reasonably current if that’s you, you’re ready to go.

How accurate is the AI CFO?

Finoya’s AI CFO is as accurate as the underlying accounting data and the way the client file is maintained. The platform is built to stay grounded in the connected source data and to avoid guessing. When certainty is low, the right behaviour is to flag the limitation, not to hallucinate confidence.

How long does setup take?

About 5 minutes to connect your accounting software. You’ll start seeing insights within 1 hour. The more historical data you have, the better the forecasts, but it works right away.

Which accounting software does Finoya integrate with?

Finoya supports one click style integrations across 20 plus accounting platforms, including QuickBooks and Xero, plus other major providers used globally.

Is AI usage limited?

No. You can ask as many questions and run scenarios as needed. Finoya is built for ongoing advisory work, not occasional usage.

Is my data secure?

Yes. Finoya is built with strict guardrails for financial data handling, with read only style analysis and controlled outputs grounded in the connected accounting data.

Will this work for my type of business?

Finoya works for most small businesses: retail, professional services, e-commerce, construction, healthcare, agencies, SaaS, restaurants, and more. If you have revenue coming in, expenses going out, and want to make better financial decisions, it’ll work for you.