Add $100K+ in Advisory Revenue This Year Without Adding Staff

Give all your clients CFO-level insights, 24/7 cash flow monitoring, and instant answers to their business questions.

AI that enhances your expertise. Never replaces it.

✓ 7 Day Free Trial. No Credit Card Needed.

✓ All client portfolios in one view.

✓ Full AI CFO access across every client

Finoya connects with 20 plus accounting platforms and keeps your data automatically in sync. Set up first client in under 5 minutes

🔒 Your client data is always private, encrypted, and secure.

Why Accountants are adding AI CFO to their practice

Connect Your Client Portfolio

Add clients and connect their accounting platform securely. Takes 5 minutes per client. Finoya syncs automatically from then on no exports, no manual updates, no chasing files.

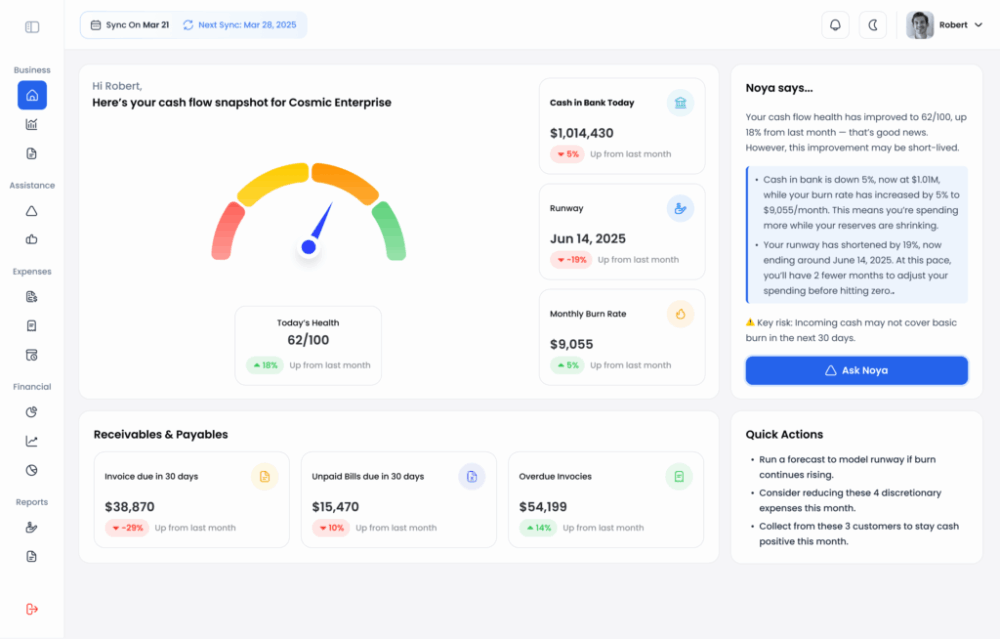

Finoya Monitors Every Client Continuously

Cash flow health, AR aging, burn rate, unusual transactions, forecast accuracy. Finoya tracks it all and flags anything that needs your attention before it becomes urgent.

Clients Get Self-Service Answers

Your clients can ask questions in plain English: “Can we make payroll if our top client pays late?” or “Should we lease or buy this equipment?” They get specific answers based on their actual financials, not generic blog advice.

You Focus on High-Value Advisory

Review insights, guide strategic decisions, and charge for expertise not data entry. Finoya handles the “grunt work” of monitoring and routine analysis.

Position Premium Advisory Services

Use Finoya as your platform to offer tiered advisory packages:

- Basic: Tax + Bookkeeping

- Advisory: Everything above + AI CFO monitoring

- Premium: Everything above + monthly strategy sessions with you

What this means for your practice

Before Finoya:

- Clients only reach out for tax preparation or for compliance work.

- Clients email financial questions but on ad-hoc basis.

- You manually pull reports from their accounting systems

- You spot problems during reviews after they’ve already developed

- You explain the same cash flow concepts to every client

- Clients make decisions based on gut feel while waiting for your input

After Finoya:

- You have an ongoing relationship with your clients year round.

- Clients get instant answers backed by their real data, 24/7

- All client portfolios sync automatically in one dashboard

- You see every client’s financial health at a glance

- Noya alerts you to risks before clients notice them

- Clients make confident decisions between your meetings

- You lead strategy calls, not spend them building context

FAQ for Accounting Firms

How is this different from the reporting tools we already use?

Your current tools show what happened. Finoya shows what’s happening now and what’s coming next. Plus, it lets clients ask questions and get answers instantly based on their data something static reports can’t do.

Will clients think they don't need us anymore?

Opposite. Finoya makes clients MORE engaged with their finances, which means they value advisory services more. You’re not being replaced you’re being elevated from “compliance person” to “strategic partner.” The AI handles routine questions so you focus on high-value strategy.

Do we need to learn new software?

No. You connect clients’ existing accounting platforms, and Finoya handles everything automatically. Your clients can interact with Noya if they want, but it works even if they never open it. You just check the dashboard when you want to see their financial health.

Can I use Finoya internally first before clients see anything?

Yes. Most Accountants start by using Finoya internally with existing clients. You connect the accounting data, review insights, and use it to prepare for meetings. Clients can be given access when you are ready.

What if clients ask questions we'd answer differently?

You can review all interactions, adjust recommendations, and set guidelines for how Noya responds. Think of it as training a junior analyst to follow your methodology but one that never needs sleep and works across all your clients simultaneously.

What if a client questions the insights or numbers?

Finoya’s insights are based on the client’s accounting data. You can trace results back to the underlying numbers, which makes your conversations defensible. If something looks off, it is usually a data quality issue or a categorisation issue in the accounting file, and Finoya helps surface that quickly.

What if client data is incomplete or not fully reconciled?

Finoya works with the data available and highlights when gaps affect results. It does not invent missing numbers. If a ledger is messy, Finoya will still surface trends and risks, but you will get the most accurate outcomes once the basics are reconciled and categorised correctly.

How accurate is the AI CFO?

Finoya’s AI CFO is as accurate as the underlying accounting data and the way the client file is maintained. The platform is built to stay grounded in the connected source data and to avoid guessing. When certainty is low, the right behaviour is to flag the limitation, not to hallucinate confidence.

How do we charge for this service?

Most firms either:

(a) Bundle it into an advisory tier priced $150-$300/month,

or

(b) Add it as a $99-$199/month add-on to existing services.

Either way, the margin is significant since Finoya costs $39 per client and you can also get volume discount.

Can I white label Finoya for my practice?

Yes. White label is available as an add on. It is designed for Accounting firms that want clients to experience the AI CFO under their brand, while you keep full control of the relationship.

How long does setup take per client?

Setup is fast and under 5 minutes per client. Connect the client’s accounting platform via secure authorisation and Finoya starts syncing. Most clients can be connected in minutes, not days. No exports, no spreadsheets, no recurring manual updates.

Which accounting software does Finoya integrate with?

Finoya supports one click style integrations across 20 plus accounting platforms, including QuickBooks and Xero, plus other major providers used globally. If you have a specific platform mix across your client base, we can confirm coverage quickly.

Is AI usage limited?

No. You can ask questions and run scenarios as needed across your client portfolio. Finoya is built for ongoing advisory work, not occasional usage.

Is client data secure?

Yes. Data access is scoped by client and organisation and is designed to prevent cross client leakage. Finoya is built with strict guardrails for financial data handling, with read only style analysis and controlled outputs grounded in the connected accounting data.

Do you provide onboarding or support?

Yes. You get onboarding support and help documentation, plus direct support for setup, integrations, and workflows as you scale your client portfolio.

What an AI CFO actually means for an Accounting Firm

An AI CFO is not a chatbot and it is not a replacement for professional judgment. For an Accountant Firm, an AI CFO is a continuously running analytical layer that monitors every client’s financial data and highlights changes that matter before they become problems.

Instead of relying on meeting cycles or manual reviews, cash flow, receivables, payables, burn rate, and forecast assumptions are evaluated in the background using real accounting data. When something deviates from expectations, the AI CFO surfaces it immediately with context tied to the underlying numbers.

This is fundamentally different from generic AI tools, which operate on assumptions and examples rather than live financial data. An AI CFO works with real transactions and real cash positions, which allows you to stay ahead across multiple clients without rebuilding context.

Judgment and decision making remain human responsibilities. The AI CFO handles monitoring, pattern detection, and speed. That is what allows a fractional CFO to apply expertise more consistently across more clients without adding hours.